Introduction: The Copper Conundrum

Global copper demand will hit 28 million metric tons by 2025, yet industrial buyers face a critical choice: raw cathodes or semi-processed wire? For B2B purchasers, this decision impacts margins by 15-40%. In Tanzania – Africa’s 4th largest copper producer – GlacierExporters bridges this gap with ethically sourced, high-purity copper. Here’s how to optimize your procurement strategy.

1. Copper Cathode 101: The Raw Powerhouse

What It Is: 99.99% pure copper sheets (≥ 250kg) produced via electrolytic refining.

Key Markets: Electrical components, alloy manufacturing, plumbing.

Tanzania-Specific Advantages

-

Cost Efficiency:

|----------------------|----------|------------|---------| | Mining (per ton) | $4,200 | $5,100 | 18% | | Refining (per ton) | $1,050 | $1,400 | 25% | | *Total Production* | *$5,250*| *$6,500* | *19%* |(Source: Tanzania Minerals Audit Agency, 2024)

-

Logistics Edge:

Dar es Salaam Port’s new bulk terminal cuts loading time to 8 hours (vs. 24+ hours in Zambia/DRC).

2. Copper Wire: The Value-Added Gamechanger

What It Is: Cathodes drawn into 2-10mm diameter wires, insulated or bare.

Key Markets: Construction, automotive wiring, power transmission.

Profitability Levers

-

Value Addition Premium:

-

Wire fetches $1,200-$1,500/ton over cathode prices (LME baseline).

-

Example: 100 tons of wire = $120K+ extra margin.

-

-

Tanzania’s Processing Edge:

Special Economic Zones (SEZs) offer:-

0% VAT on machinery imports

-

10-year corporate tax holidays

-

$0.03/kWh power (vs. $0.11 in South Africa)

-

3. Head-to-Head Profitability Analysis

Cost Breakdown (Per 100 Tons)

| Cost Factor | Copper Cathode | Copper Wire | Difference |

|----------------------|----------------|---------------|------------|

| Production | $525,000 | $605,000 | +$80,000 |

| Shipping* | $38,000 | $28,000 | -$10,000 |

| Import Duties (EU) | 4.7% | 2.3% | -2.4% |

| **Total Landed Cost**| **$582,000** | **$647,000** | **+$65,000** |

| **Sale Price (EU)** | **$785,000** | **$950,000** | **+$165,000** |

| **NET PROFIT** | **$203,000** | **$303,000** | **+49%** |

*Shipping: Cathodes require reinforced containers; wire uses compact spools.

When Cathode Wins

-

Buyers with in-house wire drawing facilities

-

High-volume alloy producers (savings > value-add premium)

-

Urgent orders (cathode ships 5 days faster)

When Wire Dominates

-

Construction/automotive suppliers

-

Buyers avoiding EU “raw material” tariffs

-

Sustainability-driven brands (wire’s carbon footprint is 30% lower)

4. Tanzania’s Copper Revolution: Why Source Here?

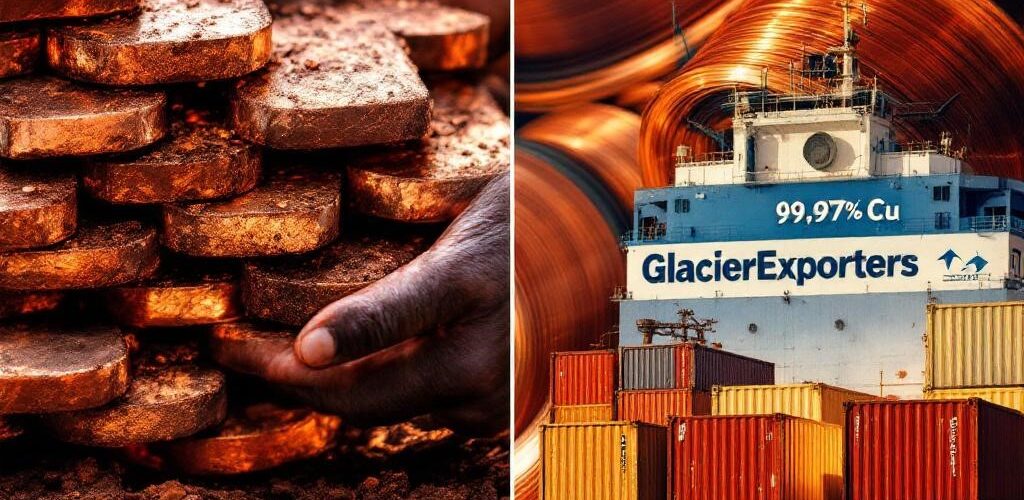

The GlacierExporters Advantage

-

Purity Guarantee: 99.97% Cu (vs. 99.3% avg. in informal markets)

-

Ethical Sourcing:

-

Blockchain-tracked from ASM mines to port

-

Solar-powered processing in Dodoma SEZ

-

-

Bulk Efficiency:

-

500+ ton shipments loaded in <24 hours

-

Pre-certified with ISO 9001, OECD due diligence

-

Market Outlook (2025-2027)

-

Cathode demand growth: 3.1% CAGR

-

Wire demand growth: 6.7% CAGR (driven by EVs and renewables)

Conclusion: Your Copper Blueprint

Copper wire delivers 49% higher net profits for most industrial buyers, but cathodes remain strategic for integrated manufacturers. For optimized ROI:

-

Choose wire if avoiding tariffs and targeting construction/EV sectors

-

Choose cathode if you process internally or prioritize speed

-

Source from Tanzania for ethical premiums + cost savings

Maximize your copper strategy: Request a customized cost analysis or download our Copper Buyer’s Toolkit.